Debt and Covetousness

Money is a terrible master, but it’s a good servant.

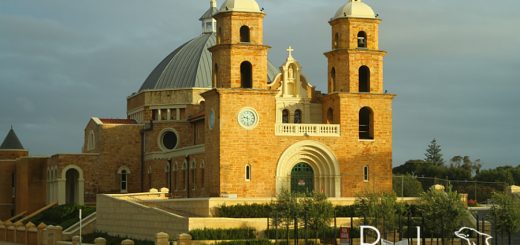

I don’t think that I am a materialistic person, however we learned in a sermon by Dr. Michael Duffy in church a few Sundays ago, that ‘wanting stuff’ is basically in our fallen nature. He went on to say, “You don’t really have to teach a child how to want stuff, you do have to teach them to SHARE.”

He defined covetousness as “valuing stuff over relationships.”

It’s a destructive sin.

It’s a trap and a lie we believe (hence the commercial ads on television making us believe we need the latest and greatest).

It never bring satisfaction, in fact, intensifies the lust. Enough is never enough.

Mike Duffy went on to share that if you didn’t believe that we don’t have enough stuff, take a look at the business of storage units in America.

Stuff has to be paid for and with that, he mentioned a 2007 study. If you have a net worth of $4,400, you are are in the upper 50%. NET meaning after taking into consideration what you have and what you owe out, that is your net worth. Which made me think, even millionaires who have to be in the upper 50% the average is $4,400??

He also said the average inheritance is spent in 18 months.

Here are some more debt statistics:

The total amount of consumer debt in the United States stands at nearly $2.5 trillion dollars – and based on the latest Census statistics, that works out to be nearly $8,200 in debt for every man, woman and child that lives here in the US. (that doesn’t take into account your mortgage).

According to information gathered by the US Census bureau, there were approximately 164 million credit card holders in the United States in 2003 and that number is projected to grow to 176 million Americans by 2008. These same Americans own approximately 1.5 billion cards – an average of nearly nine credit cards issued per credit card holder.

In addition, Americans charged approximately $1,735 billion dollars to their credit cards in 2003 – that’s just over $10,500 in charges. This information includes all credit card types including bank cards, phone cars, as well as credit cards issued by oil companies and retail store.

This data also tells us that Americans carried approximately $786 billion in credit card debt and that number is expected to grow to a projected $965 billion by the year 2008. This works out to nearly $4,800 in credit card debt per cardholder (not household) and that number is expected to increase to nearly $5,500 by 2008.

- Roughly 2.0 to 2.5 million Americans seek the help of a credit counselor each year, mostly to avoid bankruptcy.

- From 1990 to 2000, the number of Americans seeking the help of a credit counselor doubled.

- In two thirds of the counseling cases, the individual is referred to a household budget counselor, financial advisor or a social worker

- Many individuals experiencing financial difficulties have experienced a job loss, an interruption to their income due to illness, or a divorce / separation.

- Nearly 75% of those seeking help from a credit counselor held a credit card.

- The average person seeking a credit counselor carries a balance on two credit cards.

- The average client seeking the help of a counselor had $43,000 in debt, of which $20,000 was consumer debt and $8,500 was revolving debt.

His final words, be content with what God has given you. How much isn’t the issue, it’s what you do with it.

“He defined covetousness as “valuing stuff over relationships.—

Excellent definition. It is so easy to get into that trap.

Money can’t buy happiness (studies prove this out, except for those in complete poverty) but mismanaging money can buy unhappiness.